Unsure on which to go for?

Apply with our eligibility check

Protect your

credit score

We'll run a soft search that

won't have any impact to

your credit file

Instant

decision

Find out how likely you are

to be accepted for an

account

Find out your

credit limit

Get a view of how much you

could borrow before

you apply

Which credit option is best for you?

|

|

|

|---|---|---|

| Pay nothing today^^ |  |

|

| Interest free payments |

(When you pay off your balance in full each month) |

(When you pay each ‘pay in 3’ payment in full and on time) |

| Available to use online |  |

|

| Available to use in-store |  |

|

| 10% off your first order over £20‡ |  |

|

| Priority VIP Sale access** |  |

|

| Shop partner site(s) |  |

|

30 day trial of  *† *† |

|

|

Please note only one credit product is available per customer.

To transfer to another credit product, the original account must be closed

beforehand, and it's important to note another credit search would take place

against your file. Once a credit account has been opened, this will become your

sole method of payment on next.co.uk.

Please consider your personal circumstance before signing up to a credit

account, and ensure you fully understand the terms and your ability to repay.

Frequently asked questions

If you have a nextpay credit account

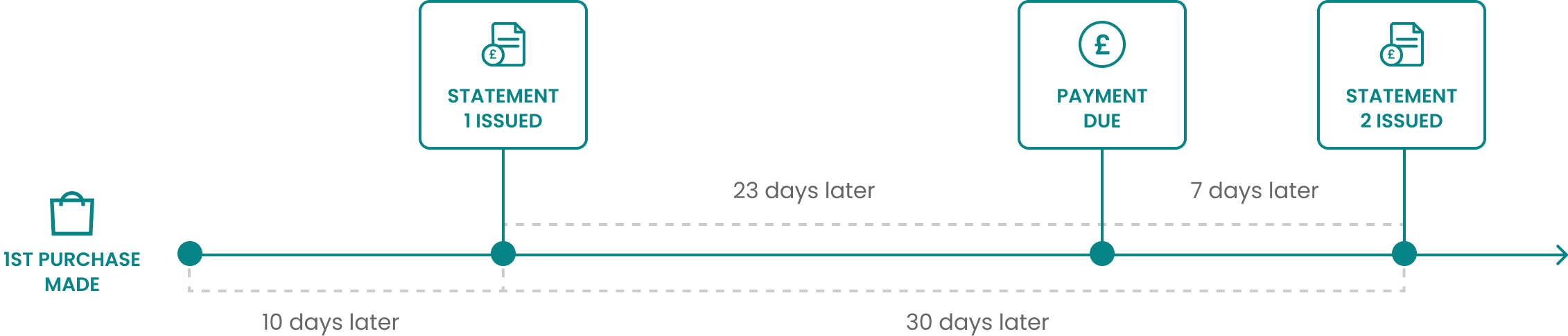

A statement will be produced no more than 10 days after the first transaction is applied to your account, then on the same day each month where required. This day may change following a period of inactivity. We will not send you a statement where we are not required to do so, for example, where you have not placed an order and there is no outstanding balance.

If you have a pay in 3 credit account

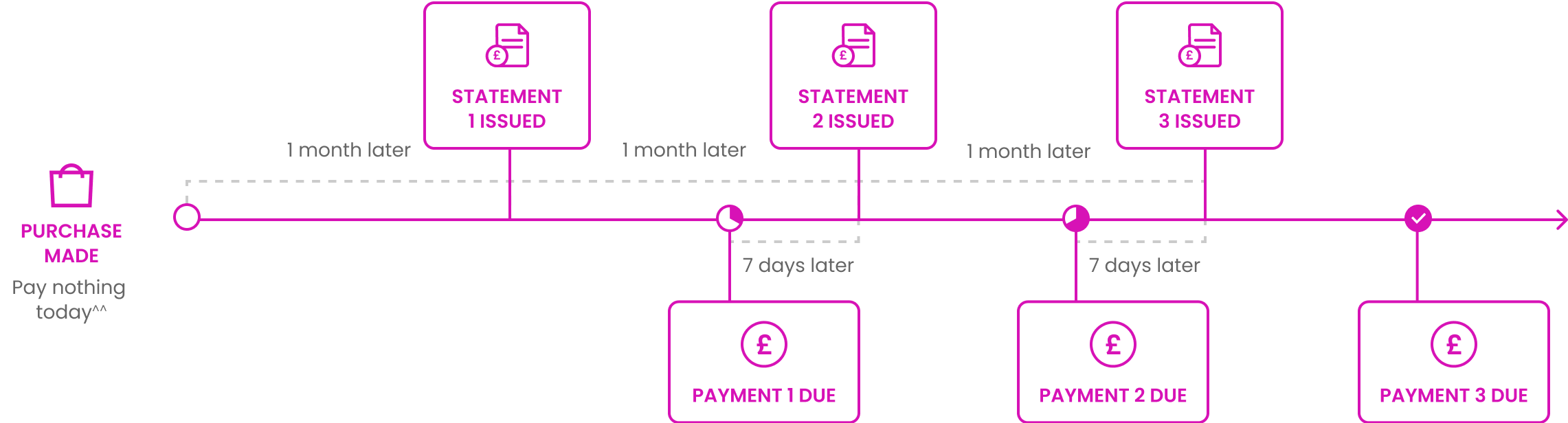

A statement will be produced up to a month after your Account is created and in each subsequent month where required. We will not send you a statement where we are not required to do so. For example, where there are no transactions in the month and there is no outstanding balance.

Remember

You can easily access your account and view your statements online through My Account.

Details of when your required minimum payment is due will show on both your statement and online through My Account. You can always pay more than the minimum payment up to the full balance of your account.

To view this, simply log into My Account and navigate to ‘Account Summary’.

You can also view your statements which will show your order details and when the minimum payment is due. Where we have an email and mobile number, we will send you an email and an SMS to let you know that your statement is ready to view.

Please note, if you only pay the minimum payment, it will take longer and cost more to repay your balance.

If for any reason you are unable to make your minimum payment, it is crucial that you contact us so we can support you.

Get in touch via contact form, or chat with us here.

nextpay Credit Account

We will calculate the Minimum Payment as the higher of £5 or 5% of your Account balance (excluding any default charges added in that statement period) rounded up to the nearest £1, plus any default charges added in that statement period. If your balance, excluding any default charges added in that statement period, is less than £5, your Minimum Payment will be the full outstanding balance on your account at the time the statement is generated.

If you do not repay the balance in full, by the date shown on your statement, you will be charged interest.

pay in 3 Credit Account

We will calculate the Minimum Payment as the higher of £5 or 5% of your Account balance (excluding any default charges added in that statement period) rounded up to the nearest £0.01, plus any default charges added in that statement period. If your balance, excluding any default charges added in that statement period, is less than £5, your Minimum Payment will be the full outstanding balance on your Account at the time the statement is generated.

nextpay and pay in 3 Credit Accounts

We will calculate the Minimum Payment as the higher of £5 or 5% of your Account balance (excluding any default charges added in that statement period) rounded up to the nearest £0.01, plus any default charges added in that statement period. If your balance, excluding any default charges added in that statement period, is less than £5, your Minimum Payment will be the full outstanding balance on your Account at the time the statement is generated.

If you pay less than the monthly pay in 3 payment interest will be charged at 29.9% p.a variable.

Please note, you can have multiple pay in 3 agreements active simultaneously. If you do not pay the full pay in 3 installment on one agreement, you will incur interest on that balance. However, you can still benefit from 0% interest on another agreement while continuing to make the installments in full and on time.

nextpay and pay in 3 Credit Accounts

If you only pay the minimum payment, it will take longer to repay the balance and you will pay more overall due to interest charges. Missing a payment could have severe consequences and make obtaining credit more difficult.

You can always pay more than the minimum payment up to the full balance of your account.

If for any reason you are unable to make your minimum payment, it is crucial that you contact us via contact form, or you can chat with us here.

Failure to make minimum payments on your account each month will result in your account being suspended and default charge applied, as well as the possibility of your account being transferred to a Debt Collection Agency.

The details of your arrears will be registered on your Credit File, which can affect future lending.

Your credit limit is the amount you are able to spend using your credit facility, this is reviewed on a monthly basis. Credit limits can increase and decrease as a result of the review, or we may decide to suspend your ability to use your credit account, based on information we hold about the way you manage your account, as well as information provided by the Credit Reference Agencies.

To confirm your current Credit Limit, please sign in to My Account where you will find the most up to date information.

If you have any questions or would like to discuss your credit limit in more detail, please call us on 0333 777 8000†. Alternatively, if you would like to chat with an advisor please click here.

Customer Services Operating Hours:

8am to 9pm Monday to Friday

8am to 7pm Saturday to Sunday

To log in to your account, enter the email address you registered your account with or your customer number (this can be found on your delivery note or statement).

Enter your password and click 'Sign in'.

To view your account, click in to ‘My Account’ via the person icon from the top right menu.

Your ‘My Account’ provides an overview of your current remaining balance, minimum payment and available credit. In addition to this, you’ll also be able to see an overview of your orders, adjustments, returns, payments and credits.

Terms & Conditions

Credit subject to status. UK residents aged 18 and over.

Please note only one credit product is available per customer. To transfer to another credit product, the original account must be closed beforehand.

*^Once a credit account has been opened, this will become your sole method of payment on next.co.uk.

†For call charges contact your service provider.

Check my Eligibility

*By clicking 'check my eligibility' you are agreeing with our credit account terms and conditions.. To find out how we process your personal data please see our privacy and cookie policy.

Credit Score / Search

There will be a soft search made on your credit file to determine if you would be successful in an application for a Next credit account. A soft search is not visible to other companies and will not impact your credit score or future applications for credit. Existing customer details will be used to check eligibility.

‘Pay nothing today’

^^The credit limit may be lower than your purchase value. You will be asked to pay for any excess at the time of your purchase.

Minimum Monthly Payment

^If you only make the Minimum Payment each month, it will take longer and cost more to repay your balance.

10% off Credit Welcome Offer

‡This offer is only available to customers opening a credit account (nextpay or pay in 3) after the 15th April 2024 and may be withdrawn at any time. Minimum purchase value is £20 in a single transaction after other discounts and gift cards/e-vouchers have been applied. Excludes delivery charges, nextunlimited subscriptions and the purchase of gift cards/e-vouchers. Returns will be refunded at the discounted price paid. This offer can only be redeemed on your first qualifying purchase made on Next.co.uk and will be applied at checkout.For credit account sign ups before 15th April 2024, £10 will be credited to your account balance on the date of your first statement following your first qualifying purchase only. This offer is only available to customers opening a credit account and may be withdrawn at any time. Minimum purchase value is £15 in a single transaction after other discounts and gift cards/e-vouchers have been applied. Excludes delivery charges, nextunlimited subscriptions and the purchase of gift cards/e-vouchers. This offer can only be redeemed on purchases made on next.co.uk or in a Next store with a nextpay account. If you return items included in the order for a refund we may deduct some or all of the £10 credited to your account if the value of the items you keep is less than the minimum order value (£20).

Priority VIP access

**Priority access to our Online Sale (also known as VIP) is a benefit to nextpay and pay in 3 customers. Exclusions apply. To be allocated a priority sale shopping slot for the upcoming Sale you will need to be/stay opted in to receive marketing emails and have successfully created your nextpay or pay in 3 credit account by 11:59pm 16th December 2025. You will receive your Priority Access invite by 18th December 2025. Priority access gives you the choice of available time slots. If you sign up after the cut-off date you will be included in a subsequent Sale Invite. For more information on our VIP Sale, click here.

nextpay in-app digi card

†*An in-app nextpay card is only available to customers once a first statement has been issued and a subsequent payment has been made. Receiving the nextpay card is subject to eligibility.

pay in 3 Terms & Conditions

***If you do not make the full pay in 3 Payment in any month on time, the whole balance will become chargeable to the Standard Rate of Interest at 29.9% per annum variable (the Standard Rate). You will be given the option to pay for subsequent purchases in 3 instalments. Once a balance moves to the standard rate it cannot move back. You can choose to pay more or less than the pay in 3 Payment in any month, but you must pay at least the Minimum Payment. If you do not make at least the Minimum Payment by the due date, your account will be in arrears, which may affect your credit file.

Nextunlimited 30 day free trial terms

*†The nextunlimited 30 day free trial. By signing up to the trial you are agreeing to sign up to 12 months of nextunlimited at the end of your trial period, and that payment of £22.50 will be automatically charged to your nextpay account at the end of the trial. Available to nextpay customers only. Customers must not have had a full nextunlimited subscription in the past 6 months or 3 previous 30 day trials at any time. The trial includes 30 days of free standard home delivery. You have the right to cancel this trial at any time. Exceptions, cancellation right, terms and conditions apply.

© Copyright 2025 Next Retail Ltd, Registered Office: Desford Road, Enderby, Leicester, LE19 4AT. Registered in England & Wales No. 4521150. Next Online is a trading name of Next Retail Ltd which is authorised and regulated by the Financial Conduct Authority for Consumer Credit.

Are you sure you want to navigate away from this site?

If you navigate away from this site

you will lose your shopping bag and its contents.